TFSA & RRSP

Often, saving for the future involves using both TFSAs and RRSPs.

Annual Contribution Limits

$6,500

2023 TFSA

$7,000

2024 TFSA

$30,780

2023 RRSP

$31,560

2024 RRSP

TFSA & RRSP Eligible Investments

Withdrawing Funds

TFSA

No tax on withdrawals

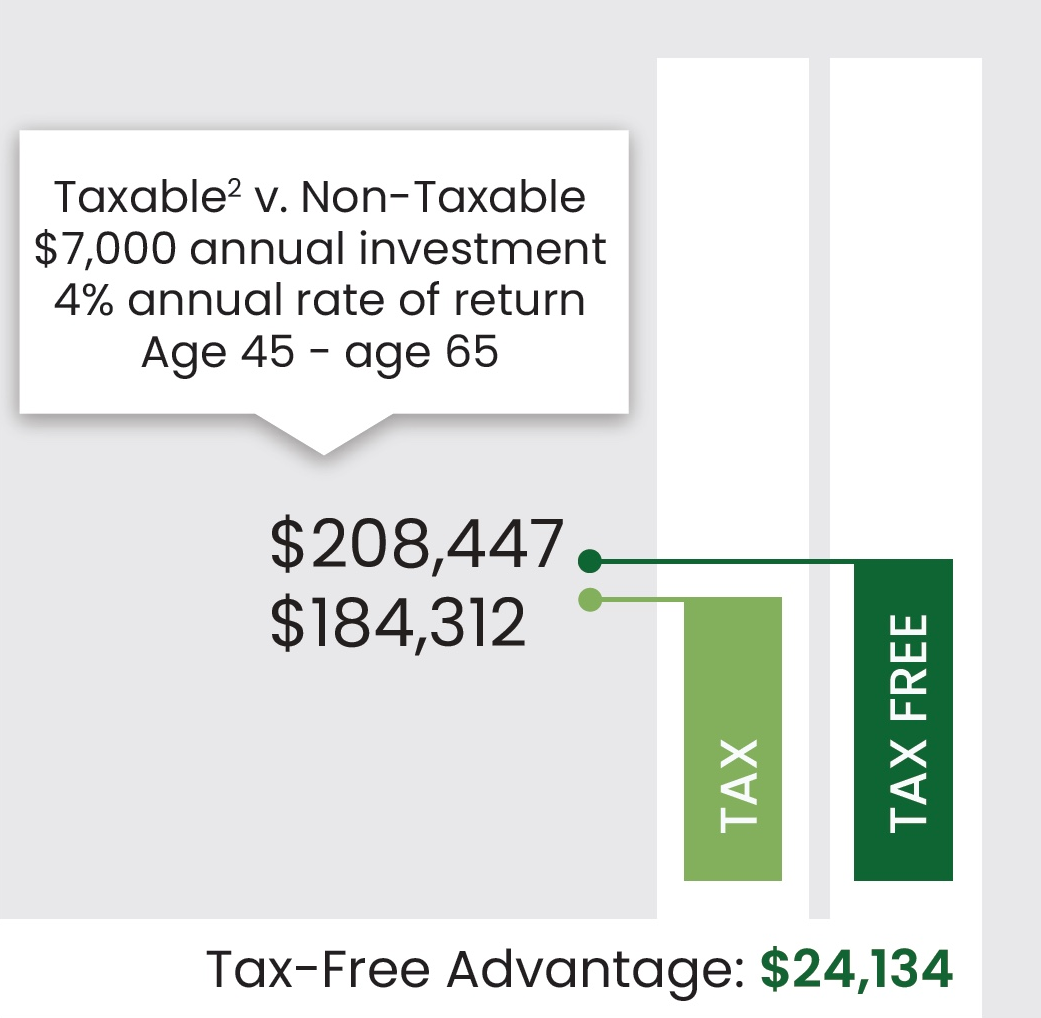

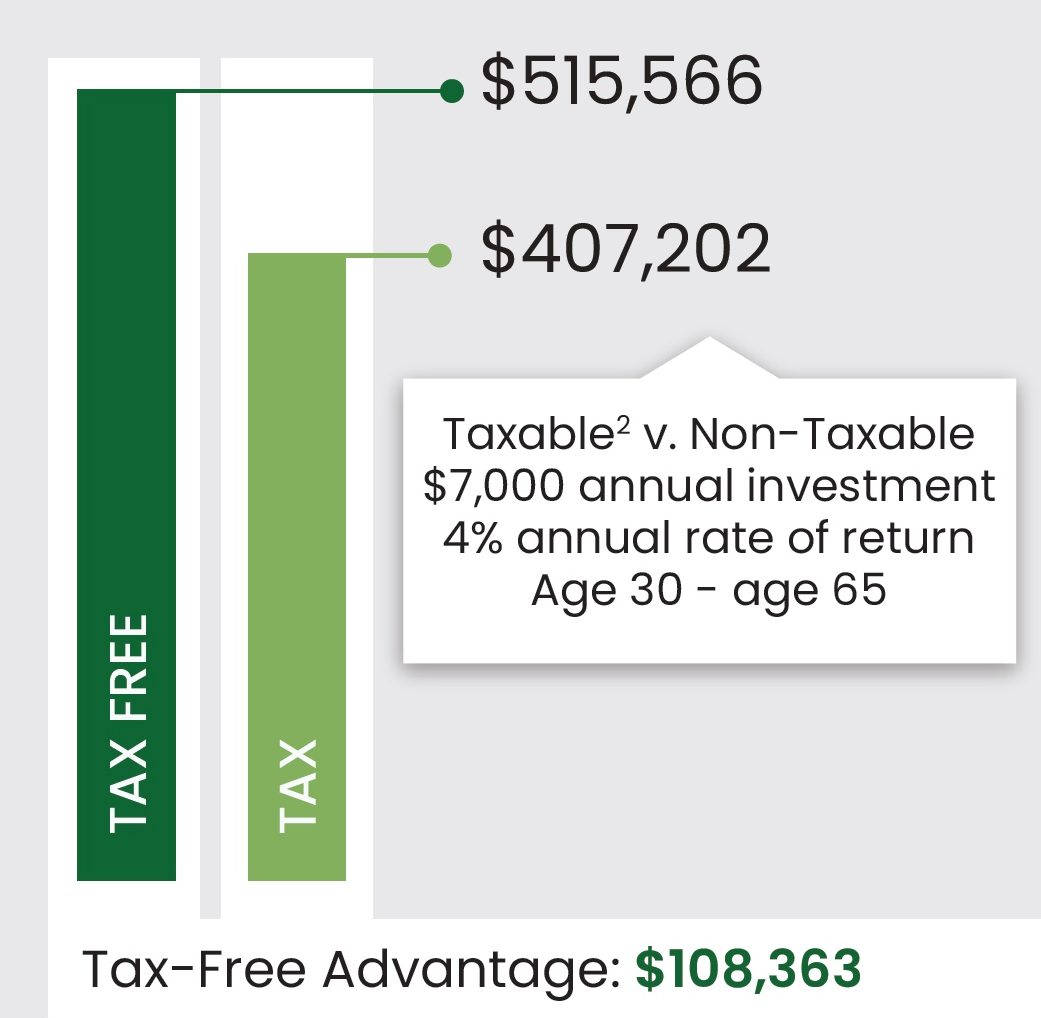

The Benefits of Tax-Free Investing

2Assumes a 30% marginal tax rate. Annual investments made at end of year.

Saving for your future can be a lengthy process.

Both TFSAs and RRSPs offer tax advantages and can help you save for your long-term and short-term financial goals.

If you have any questions, please contact us today.

Source: Canada Revenue Agency

This is a general guide only and not intended to replace professional financial and tax advice in any form. Please consult your financial advisor on how it relates to your situation. 1 Your RRSP contribution lowers your taxable income, so you're reducing the amount of tax you have to pay. *The RRSP contribution limit varies by individual. Speak with your financial advisor about maximizing your contribution.

Trademarks owned by Investment Planning Counsel Inc. and licensed to its subsidiary corporations. Investment Planning Counsel is a fully integrated wealth management company. Mutual funds available through IPC Investment Corporation and IPC Securities Corporation. Securities available through IPC Securities Corporation, a member of the Canadian Investor Protection Fund. Insurance products available through IPC Estate Services Inc. and PPI Management Inc. © Copyright 2024. Ativa Interactive. All Rights Reserved.