Are you Prepared?

While many investors have immediate concerns about how the pandemic has affected their finances, others may be looking towards the horizon with an eye on their estate.

These and other key findings on how Canadians are responding to the pandemic suggest that for those looking to secure their legacy, now may be an ideal time to finalize their plans.

Are your heirs in the dark?

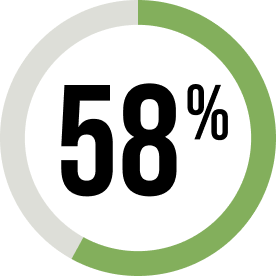

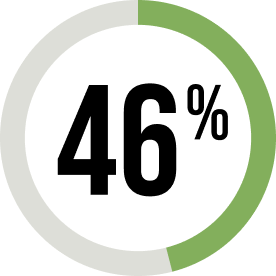

While common to defer, a lack of communication between parents and children about estate planning means that many inheritors are in the dark about their financial future and many benefactors risk not having their wishes carried out as intended.

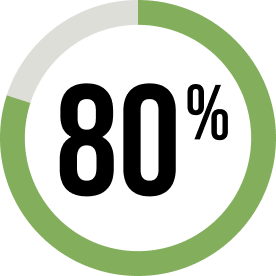

An unexpected illness or an untimely death can accelerate estate decisions, setting the stage for misunderstandings and potential family conflict down the road. Of those surveyed in a previous poll2:

To ensure your wishes are fulfilled according to your plan, talk to you heirs about your wealth transfer plans.

Watch the video

Six steps to engaging your heirs when estate planning

Personalized advice for uncertain times

When global events hit home, Canadian investors recognize the value their advisors provide and are managing their financial and family’s futures by seeking personalized advice.

More accessible advice for inter-generational wealth planning

The good news is that the pandemic has led many Canadians to adopt new communication technologies. Advisors are responding by connecting virtually with their clients, bringing together entire families whose members live in physically separate locations for in-depth intergenerational conversations.

Advice when you need it

If you have questions about planning your legacy, the reduced barriers for accessing expert advice means the answers to your concerns are only a phone call or virtual meeting away. Contact an advisor and start a conversation to see where your opportunities lie.

1The study was conducted August 13 – August 27, 2020, in partnership with Environics Research with results drawn from an online sample of 1,000 Canadian investors with $100,000 or more in investible assets that are 30 years old. 2A total of 400 well qualified respondents across Canada were interviewed using an online methodology during the period October 17 – 22, 2017. Study conducted by Environics Research. 3Based on an IPC survey of 500 investors with over $100,000 in investable assets. Survey conducted by Environics Research Group, April 2019. Investment Planning Counsel Inc. is a fully integrated wealth management company. Counsel Portfolio Services is a wholly-owned subsidiary of Investment Planning Counsel Inc. Trademarks owned by Investment Planning Counsel Inc. and licensed to its subsidiary corporations. Mutual Funds available through IPC Investment Corporation and IPC Securities Corporation. IPC Private Wealth is a division of IPC Securities Corporation. IPC Securities Corporation is a member of the Canadian Investor Protection Fund.